“In Florida — which continues to make itself a supply magnet with strong demand + the boost from the new Live Local legislation — three markets (Fort Myers, Sarasota, Daytona Beach) are seeing Class C rent cuts around 10-12%. “

via

Via Jay Parsons • Rental Housing Economist (Apartments, SFR), Speaker and Author

Yes, when you build “luxury” new apartments in big numbers, the influx of supply puts downward pressure on rents at all price points — even in the lowest-priced Class C rentals. Here’s evidence of that happening right now:

There are 12 U.S. markets where Class C rents are falling at least 6% year-over-year. What is the common denominator? You guessed it: Supply. All 12 have supply expansion rates ABOVE the U.S. average.

In Florida — which continues to make itself a supply magnet with strong demand + the boost from the new Live Local legislation — three markets (Fort Myers, Sarasota, Daytona Beach) are seeing Class C rent cuts around 10-12%. Not shown on this Top 12 list, but there are three large Florida markets with high supply also seeing Class C rent cuts of 4-5%: Orlando, Jacksonville and Tampa.

Other key markets nationally to highlight: Ultra-high-supplied big markets like Austin, Phoenix, Salt Lake City, Atlanta and Raleigh/Durham are all seeing sizable Class C rent cuts of at least 6%. Small markets on the list include Myrtle Beach, Wilmington NC, Boise and Colorado Springs.

Bear in mind that apartment demand is NOT the issue in any of these markets. They’re all demand magnets. Sure, they’ve seen some moderation / normalization for in-migration and job growth, but they’re still ranking among the national leaders for net absorption.

Simply put: Supply is doing what it’s supposed to do when you add an awful lot of it. It’s a process academics call “filtering” — which happens when higher-income renters in Class B apartments move up into higher-priced new Class A units … and then Class B units see vacancy increase, so they cut rents to lure up Class C renters. And down the line it goes.

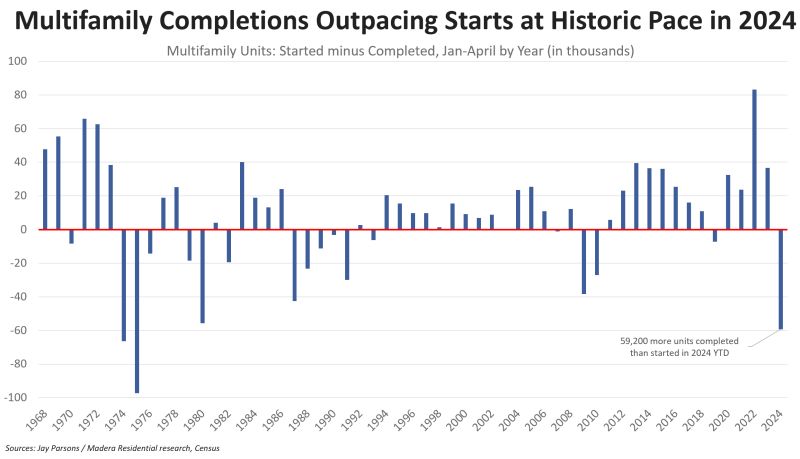

But filtering works best when we build a lot of apartments. We didn’t see this phenomenon play out as clearly in past cycles when supply was relatively limited — and (crucially) failed to keep pace with demand.

Less anyone still in doubt, here’s another factoid: Where are Class C rents growing most? You guessed it (I hope!) — in markets with little new supply. Class C rent growth topped 5% in 18 of the nation’s 150 largest metro areas, and nearly all of them have limited new apartment supply. That list includes markets like: Midland/Odessa TX, Knoxville TN, Grand Rapids MI, Dayton OH, Wichita KS, Buffalo NY, Louisville KY, Little Rock AR, and Albany NY.

Among larger markets, Cincinnati and Chicago both saw Class C rent growth near 4% — and both ranked below the U.S. average for new supply.

Most new construction tends to be Class A “luxury” because that’s what pencils out due to high cost of everything from land to labor to materials to impact fees to insurance to taxes, etc.

So critics will say: “We don’t need more luxury apartments!”

Yes, you do. Because when you build “luxury” apartments at scale, you will put downward pressure on rents at all price points.

#multifamily #affordability #housing #rentsActivate to view larger image,

You must be logged in to post a comment.