(MENAFN– Evertise Digital) Sarasota, Florida, United States, November 22, 2023 – In real estate, where the winds of economic downturns can shift markets in unpredictable ways, one sector has proven to anchor stability: Multifamily Real Estate.

As investors navigate the complexities of the real estate market, the allure of multifamily properties becomes increasingly apparent, thanks to their remarkable resilience despite economic uncertainties. But what exactly makes them so recession-proof?

Here are just 5 reasons.

Demand and Essentiality

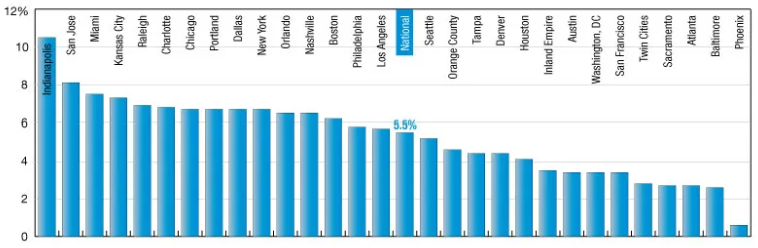

At the heart of the multifamily real estate’s recession-proof nature lies the perennial demand for housing. Irrespective of economic conditions, people require shelter, and multifamily units offer an affordable and adaptable solution to this fundamental need. This unwavering demand is not confined to a specific demographic, ranging from young professionals seeking flexibility to families and retirees desiring community living.

Moreover, the essential nature of housing provides a layer of insulation against economic storms. While other sectors may experience fluctuations in demand, the need for housing remains a constant, offering investors a reliable income stream. This consistent cash flow is a cornerstone of multifamily real estate’s recession resistance, acting as a financial buffer during challenging economic periods.

Cash Flow Consistency

Unlike some real estate investments that heavily rely on market appreciation, multifamily properties thrive on the steady cash flow generated through rental payments. This income stability provides investors a financial lifeline, allowing them to weather economic downturns more effectively. The resilience of cash flow in multifamily real estate is derived from the sector’s inherent stability – people always need a place to live, and renting multifamily units provides a cost-effective solution for a diverse range of individuals and families.

Furthermore, the consistency of cash flow contributes to a sense of predictability in the financial performance of multifamily investments. This predictability becomes a valuable asset in uncertain economic times, offering investors confidence and control over their financial outcomes. Counting on a reliable income stream enhances the appeal of multifamily real estate as a recession-resistant investment, providing a tangible advantage in navigating the ever-changing economic landscape.

Risk Mitigation Through Diversification

Another key factor contributing to the recession-proof nature of multifamily real estate is the strategic approach to risk management through diversification. Unlike single-family properties, where the financial fate is tightly linked to the economic stability of a single tenant, multifamily investments spread risk across multiple units and tenants. This diversification acts as a protective shield, minimizing vulnerability to the financial challenges of any individual tenant.

The diverse tenant base in multifamily properties, encompassing various demographics and income levels, adds an extra layer of stability. Economic downturns may impact specific industries or income brackets, but the broad spectrum of tenants in multifamily units ensures a more balanced and resilient investment portfolio. This risk-mitigation strategy is fundamental to why multifamily real estate stands strong even in tumultuous economic times.

Adaptability in Changing Markets

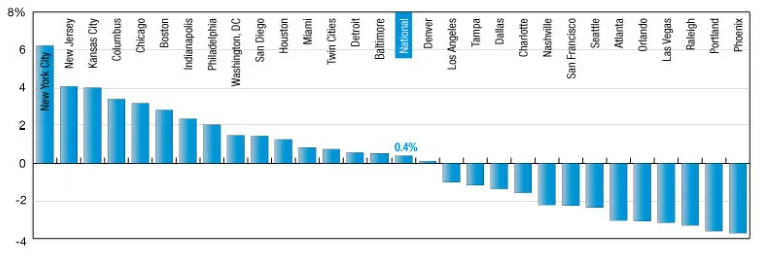

In the dynamic landscape of real estate, adaptability is a prized quality. Multifamily properties showcase a unique ability to adapt to changing market conditions. During economic downturns, the demand for homeownership may decline as potential buyers become more cautious. This shift in consumer behavior often increases demand for rental properties, particularly in the multifamily sector.

The flexibility of multifamily units to cater to varying lifestyle preferences positions them as a dynamic and responsive investment option. Investors can capitalize on this adaptability by adjusting rental strategies to meet evolving market demands. Whether providing shorter lease terms to accommodate a transient workforce or offering amenities that align with changing lifestyle preferences, multifamily real estate can pivot and thrive in response to market shifts.

The Financing Advantage

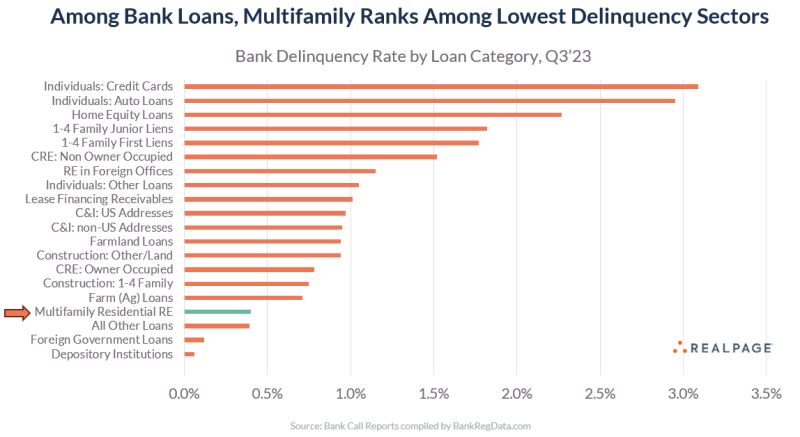

Financing plays a crucial role in real estate investments, and multifamily properties often benefit from more favorable terms, enhancing their recession-resistant profile. Government-backed loans and financing incentives are frequently available for multifamily investments, contributing to a more stable financial environment. This advantageous financing landscape reduces the upfront burden on investors and provides a buffer against interest rate fluctuations.

In times of economic uncertainty, interest rates can be a source of concern for investors. However, the financing advantages of multifamily real estate mitigate this concern, creating a more secure investment environment. Investors can easily navigate interest rate fluctuations, further solidifying the recession-resistant qualities of multifamily real estate.

This information was brought to you via MENAFN ( a PR service) by Rod Khleif pitching his current Real Estate teaching series/project. (see below)

Embrace the Knowledge to Thrive in the Multifamily Real Estate Market

To delve even deeper into the intricacies of navigating this resilient sector, consider exploring educational resources and courses tailored to multifamily real estate investments. And who better to guide you than the renowned multifamily investor and mentor, Rod Khleif ?

Rod Khleif’s courses and events are designed to equip you with the insights and skills needed to survive and thrive in any economic climate. Whether you’re a seasoned investor or just starting your real estate journey, Rod’s knowledge and practical strategies can elevate your understanding and success in multifamily real estate.

For those eager to expand their knowledge, Rod Khleif offers actionable advice and proven strategies for multifamily real estate success. Take the next step in your investment journey by exploring these resources, empowering yourself to navigate the real estate market with the guidance of a seasoned expert.

If you are actively looking for investment real estate (income-producing) assets, or considering selling and would like some guidance regarding valuation, where to begin, etc, visit Dreznin Pappas Commercial Real Estate LLC by clicking here <——

You must be logged in to post a comment.