By Jay Parsons, via Realpage.com

Follow the people. This is why you can’t look at supply alone when evaluating apartment markets. It’s supply AND demand. Not just supply. And when you look at the latest Census data on where people are going (and leaving), isn’t it remarkable how well it lines up with apartment construction trends?

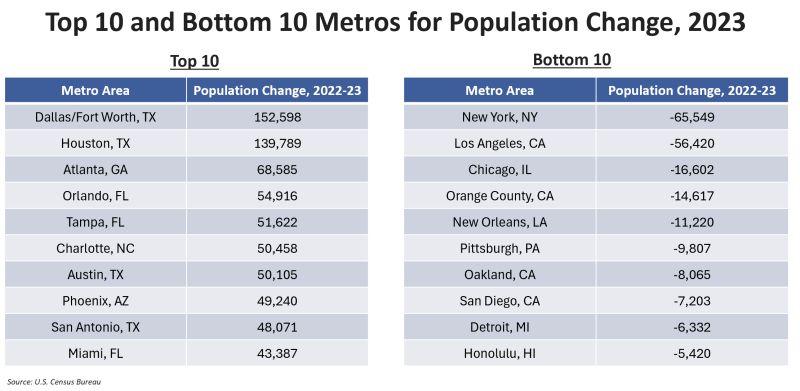

The top 10 metro areas for population growth for 2023 are all located in the high-supply Sun Belt. Texas claimed four of the top spots (DFW, Houston, Austin, San Antonio), followed by Florida with three (Orlando, Tampa, Miami), and one each from Georgia (Atlanta), North Carolina (Charlotte) and Arizona (Phoenix). Other Sun Belt metros coming close to the top 10 included Jacksonville FL, Nashville TN, Lakeland FL, Raleigh NC and Charleston SC.

What do all of those metros have in common? Several things– including A LOT of apartment supply.

Huge supply (record levels in many cases) are causing short-term digestion headaches — with rising vacancy and falling rents. But the population growth trends rather obviously point to strong rebound down the road as supply inevitably dwindles or even normalizes. The demand tailwinds haven’t evaporated. They’ve moderated or normalized since the initial COVID boom, but they haven’t gone away and likely won’t any time soon.

On the flip side, the markets losing population are probably no surprises. All are low-supply markets, but also low-demand markets. This isn’t to say apartment investors can’t be successful in these metros (after all, real estate is always local, local, local), and many certainly are quite successful. But at a macro level, I’d be leery of overplaying the “low supply” story when it’s paired with a “low demand” story.

This is a big reason why many Wall Street pundits whiffed on their West Coast outperformance outlooks last year. They doubled down too heavily on the “low supply” story, overlooking the facts that 1) the supply numbers were still elevated relative to recent history in these markets and 2) the demand story was mostly lackluster. The “undersupply” story is more nuanced than many analysts want to admit.

BUT a handful of coastal markets did see solid population growth in 2023– led by Washington DC ranking 11th nationally. Boston saw decent growth, too. Not coincidentally, DC and Boston have been the most consistent coastal core apartment performers, too. Seattle saw some growth, too.

(As an aside: I’m not a fan of simple ratios like population-to-supply. They’re not especially useful or predictive, and this is why vacancy numbers don’t align with population change. You can lose population and still see vacancy hold steady or even tick down. That’s because of household dynamics. For example, one family may decide to move out of a unit they’ve shared with another family. On the flip side, two roommates may split up to get more individual space. So while population is important, don’t look at it in a vacuum.) But that said…

Follow the people.

hashtag#populationgrowth hashtag#multifamily hashtag#housing Activate to view larger image,

You must be logged in to post a comment.