The bar is very low as 2023’s total was down by 60%.

By Richard Berger | February 06, 2024 via Gantry.com — Click here for full article and similar stories

So far this year multifamily investors have shown little inclination to reverse the slow sales trend of 2023.

Last year multifamily investment volume fell by 60% from 2022 to $117.5 billion, marking the lowest annual multifamily investment volume since 2014.

This year is supposed to be a better one all around for commercial real estate as more price transparency is established and with the promise of the Fed lowering interest rates. But the early returns aren’t promising, Chad Littell, national director of U.S. capital markets analytics at CoStar Group, tells GlobeSt.com.

January 2024’s sales volume came in lower than the historical start to the year and showed a continuation of tepid transaction volume in the back half of 2023, he said.

“Two conflicting market dynamics are creating uncertainty,” according to Littell. “On the one hand, you have interest rates broadly trending lower since the third quarter of last year, which should make debt more attractive and stimulate transaction activity.

“Although the 10-year treasury yield fell roughly 100 basis points from its recent high, it didn’t appear to be enough to goose multifamily investment activity into year-end.”

Littell said one reason to consider is that net operating income (NOI) growth is slowing and, in certain markets, is turning negative.

“The question the market is digesting is how many interest rate cuts it will take to o set rising vacancy rates due to decades-high supply deliveries,” he said.

“Vacancies aren’t rising because of a fall-o in net absorption, but rather, a steady pace of absorption is being o set by new availabilities coming online.”

Littell said the second half of 2024 could see increased transaction activity as the Federal Reserve is expected to cut its policy rate while loan maturities accelerate.

“Should these rate cuts coincide with a strong labor market and continued economic surprises to the upside, the back half of 2024 could see a return to its longer-term pre-COVID pace of transaction volume,” he said.

“In the last commercial real estate downturn, multifamily transaction activity and prices bottomed together after two years before leading the other property types into a recovery.”

One stubborn problem in the space is that the bid-ask gap between buyer and seller remains very wide with apartments and that is hindering sales, Jeff Wilcox, Principal, Gantry, tells GlobeSt.com, although he adds that investment activity in Q1 2024 will most likely mirror the annualized rate of 2023 as buyers/sellers continue to hope that the Fed reduces short-term rates in the second half of the year.

“Borrowing costs, rent growth expectations, and expense growth expectations continue to drive buyer price demands lower while sellers are anchored to what they were told in 2021-2022,” Wilcox said.

He believes that the second half of 2024 will be much more active as the Fed begins to slowly lower rates, fears of in ation subside, and the economy nails the “soft landing.”

“Sellers will not get the price they may have gotten in 2021-2022 but they will feel like they are not settling for Q2 2023 prices either,” he said.

Buyers will have more clarity on the sustainability of the economy, rental projections, and limited competitive inventory deliveries, spurring them to be slightly more risk-on.”

Also supply-demand fundamentals may be better aligned as the year continues. “Although in 2023 project completions far outweighed net absorption across the United States, it is our opinion that with construction starts dropping severely over the past 18 months, demand will outweigh new supply in 2024 and 2025,” Graham Sowden, Chief Investment O cer of RREAF says. “This will allow vacancy and rent trends to normalize over the next 18 to 24 months.”

Certain investors, meanwhile, are hunting for bargains and they are likely to find them in the multifamily space this year, Larry Connor, founder and managing partner of The Connor Group, tells GlobeSt.com.

“A significant number of properties will be hit with a valuation correction of 20% to 40%, causing many investors to run for the exits, but creating opportunity for other investors to come in and purchase properties at a discount,” Connor said.

“Even so, we see the number of properties being brought to market down 50% to 60% from a normal year. We expect to complete between $700 million and $800 million in acquisitions this year, compared to a typical year of $1 billion to $1.5 billion.”

Another example is Integra, which plans to deploy up to $150 million of equity over the next one to two years, strategically acquiring existing multifamily assets below replacement cost.

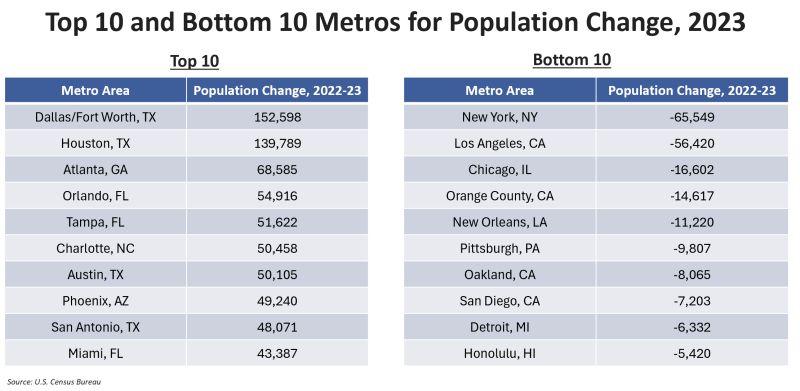

“Our focus extends to Southeast US markets with robust job and population growth, emphasizing value creation and strong cash ow opportunities,” Matt Scarola, Head of Multifamily Investments at Integra Investments tells GlobeSt.com. “As we target markets and submarkets with high short-term delivery forecasts, our approach remains grounded in recognizing complex trends of underlying job and population growth, ensuring a sustainable investment strategy.”

Brandon Polako , Principal and part of Avison Young’s Tri-State Investment Sales team, said in New York City, that he anticipates an increase in both sales volume and dollar volume, with the expectation we see a larger shift in the second half of the year.

“Still, significant appetite from private families/investors remains to park personal capital in the mid-market space (less debt) because NYC commercial real estate remains one of the top havens across the world,” Polako said.

“However, rate cuts are needed for everyone to fully jump in. At that point, we will likely achieve a herd mentality and the buyer/seller gap will narrow. This would be similar to the late summer/fall of 2021 surge coming out of COVID-19.”

James Nelson, Principal, Head of Tri-State Investment Sales, Capital Markets Group, Avison Young, said it’s important to bear in mind that the NYC 10-year average is $34.2B whereas 2023 was $9.69B.

“There should be some pent-up demand,” he said. “We could get to $15B pretty easily if there were some big ticket sales that needed to transact.”

/bnn/media/media_files/32fa9213b97a7a8382fc1a0a8d3ed61666e1c901c87401ee4643baa1b8f02bd3.jpg)

You must be logged in to post a comment.